Top U.S. States Bear Heavy Pandemic Burden

To keep tabs on all of ARSA’s work related to the current pandemic, visit arsa.org/anti-viral-measures.

As part of ARSA’s ongoing advocacy in support of additional economic relief for the aviation maintenance industry, the association surveyed its members Oct. 2 to 6 to determine pandemic-related economic disruptions on FAA certificated repair stations in the ten states that employ the most aviation maintenance workers (Arizona, California, Connecticut, Florida, Georgia, Kansas, Ohio, Oklahoma, Texas and Washington).

Repair stations in those ten states collectively employ more than half the industry’s U.S. workforce (193,857 nationwide as of March 9, 2020) and generate $16.706 billion in annual economic activity, more than half the American industry’s annual total ($27.188 billion).

Based on 47 survey responses:

- There is a strong connection between the civil aviation maintenance sector and national security. Aside from providing services to commercial and general aviation operators, 66 percent of respondents provide services to the military, 32 percent to other federal departments, 25 percent to a state, 23 percent to municipal government.

- Aviation maintenance revenues have fallen sharply in 2020. 84 percent say revenues have decreased versus 2019. 84 percent project lower revenues in 2020 vs. 2019. The average drop in 2020 revenues versus 2019 is 32 percent. ARSA projects the top ten states will collectively lose $5.346 billion in maintenance sector economic activity this year (see chart).

- The steep decline in business activity has led to significant maintenance sector job losses. Collectively, companies have lost 19 percent of their workforce since Jan 1. Projected across total employment as of March 9, repair stations in the top ten states have lost 23,736 workers (see chart).

- The very survival of many businesses is at stake. 48 percent are concerned about whether their business will survive (responded 4 or 5 to question, ”On a scale of 1 to 5, where 1 means “not at all concerned” and 5 means “very concerned,” how concerned are you about your company’s ability to survive the pandemic-related economic disruptions?”)

- More layoffs are imminent. 46 percent plan workforce reductions in 2020 (23 percent plan to permanently reduce staffing and 23 percent plan temporary furloughs).

- But additional federal economic relief can prevent job losses. 76 percent say additional federal relief would make layoffs less likely. (“If Congress were to renew or extend CARES Act relief programs and/or create new mechanisms to deliver economic assistance to the maintenance industry, do you believe it would make your company less likely to reduce its workforce?”).

The results are consistent with those from the broader ARSA member survey (below) conducted over the summer of 2020. Based on those results, ARSA projected that the U.S. maintenance industry has lost more than 50,000 jobs – almost a quarter of its workforce – since the beginning of the year.

| State | Total repair station jobs as of March 9 | Estimated jobs lost since March 9* | Annual repair station economic activity as of March 9 | Estimated lost economic activity in 2020*** |

| AZ | 6,446 | 1,225 | $882,000,000 | -$282,240,000 |

| CA | 24,429 | 4,642 | $3,315,000,000 | -$1,060,800,000 |

| CT | 4,565 | 867 | $563,000,000 | -$180,160,000 |

| FL | 19,097 | 3,628 | $2,630,000,000 | -$841,600,000 |

| GA | 19,219 | 3,652 | $2,562,000,000 | -$819,840,000 |

| KS | 5,917 | 1,124 | $717,000,000 | -$229,440,000 |

| OH | 7,487 | 1,424 | $940,000,000 | -$300,800,000 |

| OK | 12,343 | 2,345 | $1,501,000,000 | -$480,320,000 |

| TX | 16,694 | 3,172 | $2,462,000,000 | -$787,840,000 |

| WA | 8,721 | 1,657 | $1,134,000,000 | -$362,880,000 |

| Totals | 124,928 | 23,736 | $16,706,000,000 | -$5,346,000,000 |

*Total employment times average percentage of jobs lost in top ten states (19 percent).

**March 9 economic activity x average revenue decline for top ten states (32 percent).

Previous pandemic-related analysis...

7/28/20 - Grim Picture of Pandemic’s Impact on Aviation Maintenance

The aviation maintenance industry has been decimated by coronavirus-related economic disruptions, a survey by ARSA found. ARSA members reported widespread revenue declines that have in turn led to significant job losses. In the face of continued economic uncertainty, the survey results suggest more layoffs are imminent.

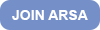

The overwhelming majority (87.8 percent) of U.S. respondents to ARSA’s June survey of FAA-certificated repair stations reported revenue declines in the first five months of the year, with an average drop of 45.9 percent from 2019 levels. Not surprisingly, 70 percent of respondents expect this year’s revenues to fall below 2019’s.

Economic volatility has led to big job losses. Aggregate employment at responding companies fell 26.8 percent, from 11,879 workers on Jan. 1 to 8,699 on June 1. If the survey results are projected across the entire maintenance industry – which had 193,857 workers as of March 9, 2020 – American repair stations may have lost more than 50,000 workers since the beginning of the year. ARSA’s findings mirror those of the Bureau of Labor Statistics, which recently reported a 25 percent reduction in year-over-year aviation industry employment.

“Maintenance companies are desperate to hold on to the technical talent they’ve worked so hard to cultivate,” ARSA Executive Vice President Christian A. Klein said. “It’s extremely disheartening to watch all these layoffs happen in an industry that just a few months ago was facing severe worker shortages. This massive loss of technical talent is going to haunt aviation for years to come.”

CARES Act Helped, But Restrictions and Limitations Likely Cost Jobs

The survey found that workforce reductions are spread unevenly, with 46.9 percent of companies reporting declines in employment, 43.2 percent reporting no change and 9.8 percent adding employees. One apparent factor is federal relief. Employment at companies that received CARES Act Paycheck Protection Program (PPP) loans fell at just 5.8 percent. However, due to various eligibility requirements for the PPP, the payroll support program for airlines and their contractors and other CARES Act programs, many repair stations, both small and large, were unable to tap into federal relief.

The PPP was far and away the most popular federal assistance program identified by survey respondents, with 54.1 percent saying their companies had received its support. Only 9.6 percent received Small Business Administration disaster loans, 4.3 percent received Air Carrier Worker Support grants or loans (aka, payroll support) and 1.5 percent received loans from the special CARES Act fund for repair stations and airlines.

The various tax preferences created by Congress in the face of the pandemic are also likely to benefit some repair stations. More than half (52.2 percent) plan to use the employee retention tax credit, 37.3 percent expect their companies to take advantage of the tax credit for sick and family leave and 32.8 percent plan to use the payroll tax deferral.

“The CARES Act and other recent legislation have saved repair station jobs, but it was clearly a mistake to make relief unavailable to small companies with unique ownership structures and to larger companies that employ the most people – particularly those not located at airports,” Klein said. “To prevent more job losses, as Congress gears up for the next round of stimulus, lawmakers must ensure than any company that needs help can get it. That means continuing the PPP, loosening the strings and making changes to eligibility for ACWS payroll support.”

As Pandemic Continues to Impact Businesses, More Job Cuts Looming

Respondents cited several ways their companies have responded to the pandemic. Two-thirds (66.7 percent) of respondents said their companies had implemented additional sanitizing and clearing of facilities between shifts, 50 percent have encouraged or mandated remote work for eligible employees, and 28.9 percent have instituted shifts to allow employees to socially distance. More companies have apparently instituted wage and salary cuts for administrative and management personal (21.1 percent of respondents) than have cut pay for all employees (14.4 percent).

Most respondents believe the maintenance industry will take a long time to recover and that business will not return to normal until next year at the earliest. Just 22.2 percent of respondents said they expect business conditions to return to pre-pandemic levels by the end of 2020, while 10 percent expect recovery by next summer, 18.9 percent by the end of next year and 22.2 percent sometime after the beginning of 2022. A fifth of respondents (20 percent) admitted they do not know when the business will return to normal and 5.6 percent said they had experienced no change in business conditions in recent months.

Among business impacts cited by survey respondents, 59.5 percent reported a drop in cash on hand, 50 percent noted airline customers have been unwilling to pay for work performed prior to the pandemic, 46.4 percent report non-airline customers have been unwilling to pay their bills, and 42.9 percent report cost increases due to heightened workplace safety measures. A rare bit of good news is that only 9.5 percent report trouble accessing credit.

Business disruptions, cash flow problems and economic uncertainty are casting a shadow over industry employment and more job losses are in the offing. Almost one third of respondents (28.9 percent) plan temporary reductions through end of the year and a tenth plan permanent layoffs. On a more positive note, 37.8 percent of respondents said their companies do not plan to change the number of employees and 13.3 percent plan to add additional workers to the payroll.

A third of respondents believe their business’s very survival is at stake. The ARSA survey asked respondents to indicate on a scale of one to five how concerned they were about their company’s ability to withstand the economic disruptions (one = not at all concerned; five = very concerned). 42.5 percent answered one or two (a low level of concern), but 33.3 percent were pessimistic about their company’s future (answering four or five).

“Whether you’re an optimist or pessimist, no one knows when things will get back to normal,” Klein said. “That lack of certainty is a strong disincentive for companies to invest and hire, so we expect the effects of the pandemic to be felt for a long time and will remain committed to helping the maintenance community mitigate them.”

ARSA’s survey was conducted online in June 2020. Of the 114 companies that respond, 98 were U.S. headquartered maintenance companies representing more than 250 repair station certificates in the United States and approximately two dozen foreign facilities.

Painting the Picture

Click here to expand the InfoGraphic; you may save a copy of the expanded image. To see versions of the graphic with only employment or revenue data, visit http://arsa.org/news-media/economic-data.