Maintenance Industry Surpasses Pre-Pandemic Peaks, Enters “Supercycle”

On March 19, ARSA used its Annual Legislative Day gathering to release its 2025 Global Fleet & MRO Market Report. The analysis provided for the association by Oliver Wyman Vector, a premier aviation, aerospace, and defense technical consulting firm, highlighted the aviation maintenance and parts manufacturing industry’s full recovery beyond pre-pandemic revenues.

Worldwide, the civil aviation maintenance industry currently includes more than 5,000 companies employing nearly half a million people. Direct revenue produced by repair, alteration, and parts production services will equate to $119 billion this year. Eighty percent of those firms and 75 percent of all employees are located in the United States, where the industry produces $69 billion in economic activity annually.

“If you talk to the airlines, 2019 was a ‘gangbusters’ year,” said Livia Hayes, Oliver Wyman Vector’s market intelligence team director, in reporting that North American passenger demand had more than surpassed that year’s level. Looking globally, Hayes noted healthy expectations for continued revenue passenger mile growth in each international market. This demand projection supports expectations for expansion of the worldwide aircraft fleet and consequently associated maintenance services; that analysis is the foundation of the market assessment’s long-term projection of nearly three percent growth in market revenues across all main service areas (line, component, airframe, and engine maintenance).

Hayes noted that despite “maintenance holiday” expectations for new products, platforms entering the market have faced unexpected issues requiring service ahead of schedule. These unscheduled visits coupled with slowing retirement rates resulting from manufacturer production slowdowns create a “supercycle” producing hot demand for repair and alteration support.

“[Shop visits for newer products are] adding demand on top of additional demand that’s happening from the older…legacy aircraft staying in service longer,” Hayes said.

Oliver Wyman Vector’s growth projections come in the context of the industry’s ongoing workforce challenges. American employment of maintenance personnel rose six percent year over year, Hayes reported, and 17 percent above the “gangbusters” market levels of 2019. Nonetheless, the analysis indicated an ongoing shortage of technicians, with baseline supply impacted by the “juniority” of entering individuals traveling longer learning curves to productivity.

“Having a person retire with 25, 35 years of experience, particularly during the COVID wave, and being replaced by someone new or with two or three years’ experience is not as productive,” Hayes said. “[The industry reports] anywhere from two to three to even five years before a new technician is fully productive.”

Providing training and other resources to bolster that productivity is central to ARSA’s career development initiatives for maintenance providers. From regulatory compliance sessions to FAA grant opportunities to “illustrations” of technical career paths in aerospace, the association directs its members towards improved productivity and efficiency while maintaining safety and compliance awareness.

“Oliver Wyman Vector’s reports have become a mainstay in ARSA’s advocacy toolkit,” said Christian Klein, the association’s executive vice president. “The total numbers and state-level breakdowns are invaluable for our members and sought after by policymakers and the media. This year’s data reinforces the ongoing story ARSA has told about the value of maintenance work and the importance of the people performing it.”

The complete Global Fleet & MRO Market Forecast 2025-2035 is available to ARSA members, who may request a digital copy by contacting the association. For the executive summary, state-by-state information sheet, and other data resources from ARSA, visit arsa.org/news-media/economic-data. Members can view a recording of Hayes’ presentation in the March 2025 edition of the hotline.

ARSA’s Legislative Day is part of its four-day Annual Conference. To learn more about the Conference, which the association hosts each March, visit arsa.org/news-media/events/arsa-conference.

Previously Market Report releases from ARSA...

3/28/24 - ARSA Report Shows North America Powers $100 Billion Global Industry

March 28, 2024

On March 13, ARSA released its 2024 Global Fleet & MRO Market Assessment. The report, produced each year for ARSA by global consulting firm Oliver Wyman, shows the international maintenance market has surpassed $100 billion in direct annual spending.

The 4,000 maintenance firms located in the United States employ nearly 185,000 people and produce almost $65 billion in economic activity (not including indirect spending on business services and related community impact. The 2024 data shows that American entities employ roughly 44 percent of the total global workforce and account for more than 60 percent of the world’s maintenance revenue.

While North America – which remains host to the world’s largest aircraft fleet even as the Chinese market surges – represents the backbone of the global industry, it also carries its share of the aviation community’s challenges. As has been reported by Oliver Wyman for much of the past decade, the American industry faces significant workforce and career development needs. Even with modest growth projections – the total market is expected to grow at just shy of two percent through 2034 – repair and parts production professionals need new ways to recruit, train, and retain new talent.

During her presentation of this year’s report at ARSA’s Legislative Day (part of its Annual Conference), Oliver Wyman Transportation and Services Practice Director Livia Hayes projected a current shortage of roughly 24,000 individuals against the total workforce needed to meet capacity demands in the United States and Canada alone. “Based on the previous analysis, the shortage grows to nearly 40,000 [by] 2028,” Hayes said. “Also, I think the retirement wave came a little bit sooner than we were anticipating because of COVID but it is by no means over…so it gets a lot worse before it gets better towards the 2030s.”

The Oliver Wyman report is a tool for both ARSA and the industry to illustrate the importance, needs, and interdependence of the global maintenance industry. As U.S. employers search for competent personnel and American regulators weigh policies that complicate international business (e.g., bilateral parts documentation issues between the FAA and EASA, drug & alcohol testing requirements for foreign repair station personnel), this year’s data is vital in helping support U.S. industry while bolstering a globally vital market.

The complete Market Report is available only to ARSA members, for more information visit the association’s Data & Advocacy Page. ARSA members can view a recording of Hayes’ presentation in the March 2024 edition of the hotline.

3/28/23 - Aviation Maintenance Returning to Growth in Face of Constraints

March 28, 2023

ARSA released its updated Global Fleet & MRO Market Report during its 2023 Annual Conference on March 15. The report, which is prepared by Oliver Wyman CAVOK, indicates that while constraints exist, the pandemic is no longer driving fleet growth or maintenance demand.

For both Oliver Wyman’s data and industry planning, this emergence from the business disruptions that began in 2020 allows for a return to more traditional modeling expectations. Aircraft and parts availability, supply chain volatility, and most pressingly workforce demands will determine how fully the global industry can recover and grow.

The report was briefed to ARSA’s attendees during the Legislative Day portion of its Conference, providing economic background to support later discussions with members of Congress and their staffs. Livia Hayes, Oliver Wyman CAVOK director, presented the findings to participants, illustrating the current and projected states of the North American and global aircraft fleets and related impacts on maintenance demand.

Hayes reported that the active fleet is almost back to pre-pandemic levels and in North America it is larger than in 2019. Passenger demand is expected to recover fully by 2024, with aircraft utilization rising steadily. These factors combined with several years of limited deliveries of new airframes – which kept average fleet ages high despite retirements of older aircraft – will drive maintenance demand for the decade: The market is expected to grow by a rate just shy of three percent through the 2030s.

Turning her focus to workforce, which received considerable discussion throughout ARSA’s Conference, Hayes noted that more than 300,000 Americans work in aviation maintenance and production, with 56 percent working at repair stations. These individuals combine to produce almost $63 billion in annual revenue for American firms as part of a global industry approaching $100 billion.

Hayes noted the top states for maintenance employment remain consistent year over year, with 42 percent of the total aviation maintenance workforce living in Florida, California, Texas, Georgia, and Ohio. In subsequent discussion, ARSA Executive Vice President Christian Klein noted that while big states always top lists of employment and investment, there are others, like Oklahoma, where aviation maintenance employment per-capita actually leads the nation even though its total employment falls outside the top five.

While ARSA members are already reporting considerable issues related to technician employment, the Oliver Wyman data indicate workforce challenges will continue. Even in its most optimistic scenario, the report indicates technician demand is likely to outstrip supply until the second half of the decade. The baseline projection – and certainly the pessimistic one – fails to return supply of available personnel back to balance with demand at any point within the forecast period.

“If the industry does grow the way we’re projecting it,” Hayes said, noting that Oliver Wyman’s projections usually are within one percent of actual numbers, “We’re going to have a big problem here in a few years in a gap in [workforce] demand [and supply].”

Oliver Wyman’s suggestions for business and policy improvements to stem career development problems mirror those promoted by ARSA and also reflect the work of government-convened bodies focused on engaging youth and women in aviation careers. In response to a question, Hayes noted that compensation for maintenance employment was competitive and she counsels employers to consider “total compensation,” including lifestyle benefits, in making careers enticing to potential employees.

For more information about the report and its related resources, as well as other analyses performed by and for ARSA, visit arsa.org/news-media/economic-data. ARSA members can view a recording of Hayes’ presentation in the March 2023 edition of the hotline.

3/22/22 - Market Report Shows a Resilient Restart

March 22, 2022

On March 9, ARSA released its 2022 Global Fleet & MRO Market Forecast, prepared by Oliver Wyman. The report’s findings were presented by Anthony DiNota, Oliver Wyman CAVOK senior vice president and general manager, to participants in the Legislative Day portion of the association’s Annual Conference.

The report presents a thorough picture of the active recovery of the commercial aviation market from the impacts of the global pandemic. The global in-service fleet had returned to 93 percent of its pre-COVID size by Jan. 1, 2022, with demand and overall utilization trending towards recovery. The air transport maintenance market represented $78.6 billion in global economic activity and is forecast to reach $118 billion by 2030. That expectation is 13 percent below the pre-COVID prediction of $135 billion by the end of the decade.

“This year’s forecast demonstrates the amazing resilience of the industry,” ARSA Vice President of Operations Brett Levanto said about the report. “ARSA’s 2019 report included a sensitivity analysis in which the ‘bottom of the barrel’ scenario limited air carrier maintenance revenues to $99.5 billion by 2029. It’s fair to say we discovered a lower bottom of a deeper barrel than imagined, yet revenues are on track to land billions ahead.”

Employment and workforce issues remain central to industry growth. In the United States, the number of maintenance personnel stands at nearly 280,000 people producing almost $50 billion in annual revenue. After the severe turbulence of 2020, the American market has returned to 90 percent of the projection included in ARSA’s 2020 market report released as the pandemic’s first impacts were felt. As reflected in data collected year over year through ARSA’s member survey, finding technically skilled workers remains a top concern of repair stations trying to keep pace with larger market recovery.

“There’s been a lot of fluctuation in the past two years, but one thing remains the same: repair stations continue to drive maintenance employment in the United States,” said ARSA Executive Vice President Christian Klein, noting that 66 percent of current American employment falls at part 145 certificated facilities. “As we’ve seen year over year, there are almost seven times more men and women working in our component shops and contract airframe or engine facilities than there are airline mechanics. Serving that community is going to be essential to aviation-wide growth. Every position waiting to be filled represents lost money for businesses and the delayed start (or continuation) of a rewarding career for skilled technicians.”

The value of each person in the industry was displayed in the report, which included its first assessment of economic output per employee. Confirming numbers calculated by ARSA for years using its own survey data, Oliver Wyman found that each individual working in maintenance accounts for more than $170,000 in annual revenue.

To learn more about the 2022 ARSA Annual Conference, visit arsa.org/conference.

2022 Global Fleet & MRO Market Forecast

prepared by Oliver Wyman

Executive Summary: 2022 Global Fleet & MRO Market Forecast

U.S. state-by-state overview of 2022 employment & economic impact

Oliver Wyman Interactive Forecast Dashboard

4/6/21 - Hotline Highlight - Cautious Optimism

April 6, 2021

The hotline – ARSA’s premier member newsletter – contains news, editorial content, analysis and resources for the aviation maintenance community. All members should ensure they receive their edition the first week of each month. Not getting yours? We can fix that.

This “hotline highlight” is presented along with the content related to the annual release of ARSA’s Global Fleet & MRO Market Assessment. To review other “highlights,” visit arsa.org/hotline-highlight or search arsa.org.

In this edition…

Living On

While the recordings made during the 2021 Annual Conference will carry on the voices of participants, their work will live on – like the memory of old friends and mentors – because of the long-term determination of ARSA and its team. This edition of the hotline chronicles the event and presses on towards the next one.

From “2021 Economic Outlook”…

Cautious Optimism for 2021 and Beyond

For more information about the Annual Conference, including access to recordings and other resources produced during the event, visit arsa.org/conference.

The annual rollout of the Oliver Wyman/ARSA MRO market forecast in conjunction with the ARSA Conference is a must-attend event for industry leaders, reporters and policymakers interested in the aviation maintenance economic outlook. However, the release of this year’s report took on new importance as repair stations to recover from the most challenging business conditions in the industry’s history.

The annual rollout of the Oliver Wyman/ARSA MRO market forecast in conjunction with the ARSA Conference is a must-attend event for industry leaders, reporters and policymakers interested in the aviation maintenance economic outlook. However, the release of this year’s report took on new importance as repair stations to recover from the most challenging business conditions in the industry’s history.

Oliver Wyman Vice President Tom Cooper presented the report during 2021 ARSA Conference’s Legislative Day on March 10. His general assessment was that, while it will take some time to recover to pre-pandemic business activity levels, 2021 will be a much better year for the maintenance industry than 2020.

It could hardly be worse.

According to Oliver Wyman, global demand for maintenance services fell from $82.9 billion in 2019 to an estimated $50.3 billion in 2020, a 40 percent drop. Cooper said that at the height of the disruptions in the spring of 2020, global air travel demand and aircraft utilization were off by 80 percent and 75 percent respectively from prior years. 2020 was also the first time in modern commercial aviation history that the industry experienced a year-over-year decline in the active global commercial fleet size with 57 percent fewer new aircraft deliveries and twice as many aircraft retirements than in recent years.

According to Cooper, the worst is behind us and, if current positive trends continue, global demand for the active aircraft fleet is expected to fully recover by the first half of 2022 and maintenance demand will reach pre-COVID levels by second half of 2022.

However, there is still considerable uncertainty in the forecast, particularly when it comes to air carrier maintenance activity. Cooper discussed the four factors that will drive airline recovery: epidemiological timeline(whether and how the pandemic is constrained), traveler sentiment (whether people feel safe getting on aircraft), government restrictions (whether visitors will be freely welcomed from other countries) and macroeconomic conditions (whether the direction of the global economy will support a rebound in leisure and business travel).

Under Oliver Wyman’s most optimistic scenario, the global maintenance industry could grow to $117.6 billion per year by 2031. That assumes continued progress with vaccine distribution and a return to pre-COVID passenger demand levels by the end of 2022. If there are problems with vaccine distribution and/or efficacy or if the global economy fails to rebound, demand for maintenance services could be $15 billion lower than anticipated by the end of the decade.

The economic downturn took a significant toll on the industry’s workforce. An ARSA report released in mid-2020 determined repair stations had lost of quarter of their workforce to layoffs and furloughs in the first half of last year. However, with recovery taking hold, the industry workforce has rebounded slightly and is still an important driver of the U.S. economy. Oliver Wyman estimates that there are 273,000 Americans currently working in the maintenance sector (down from 296,000 pre-pandemic). Of those, two-thirds work at repair stations, 22 percent work for aircraft parts manufacturers and distributors and 11 percent are employed as airline mechanics.

“After an incredibly difficult year, ARSA members we’ve spoken to are generally optimistic about the future,” ARSA Executive Vice President Christian A. Klein said. “But as demand for maintenance services picks up, repair stations are once again facing a technical talent shortage, which we expect to be even more acute than it was pre-pandemic. After a year of just trying to survive, companies are having to pivot quickly back to recruitment and workforce development. It’s definitely causing some whiplash.”

The 2021 report’s executive summary and Oliver Wyman’s Interactive Forecast Dashboard are accessible at arsa.org/news-media/economic-data. The full report is available exclusively to ARSA members free on request. A recording of Cooper’s presentation is available to conference registrants via the event’s Online Meeting Organizer.

2021 Global Fleet & MRO Market Assessment

prepared by Oliver Wyman

Executive Summary: 2021 Global Fleet & MRO Market Forecast

Oliver Wyman Interactive Forecast Dashboard

4/14/20 - Assessing Pandemic Impacts on Maintenance Markets

April 14, 2020

Update: On April 28 at 10:00 a.m. EDT, Oliver Wyman will host a virtual event reviewing the market impacts of COVID-19. To learn more and register, click here.

On March 11, the ARSA released its 2020 Global Fleet & MRO Market Assessment. The report, which was prepared for the association by aviation management consulting firm Oliver Wyman assessed the then-current state of the global aviation maintenance market and projected continued industry growth through 2030.

Though the 2020 report contemplates the impact of the novel coronavirus on the aviation industry, its analysis was performed well before the scope of the crisis became apparent (which as of this update it still might not have). The report as written provides useful context for assessing potential impact areas on the aviation community. ARSA is working with its partners at Oliver Wyman to produce new resources to appropriately capture the “new normal” in the industry for 2020 and beyond.

The first of those resources has been made available by the consulting firm: a dashboard analyzing commercial aviation market impacts of the current pandemic. The data presented was current on March 27 and it will be updated as new analysis tools are finalized by Oliver Wyman:

[Dashboard] COVID-19 IMPACT ON COMMERCIAL AVIATION MAINTENANCE

To supplement the 2020-2030 Global Fleet & MRO Market Forecast Update, our COVID-19 impact interactive dashboard provides users with the ability to explore the near-term impact of COVID-19 on the MRO demand in a deeper fashion. Both dashboard views include a summary table that quantifies the updated MRO forecast and the corresponding impact. Click here to see the dashboard.

Oliver Wyman is also planning an April 28 webinar to review updated data and forecasts. Stay tuned for more information.

To see all of ARSA’s analytical tools for understanding the industry, visit the Data & Advocacy page.

To review previous market assessments, including the 2020 report released on March 11, see the updates below.

3/11/20 - Maintenance Market Will Grow Amid New Crises

March 11, 2020

On March 11, the ARSA released its 2020 Global Fleet & MRO Market Assessment. The report, which was prepared for the association by aviation management consulting firm Oliver Wyman assesses the current state of the global aviation maintenance market and projects continued industry growth through 2030.

On March 11, the ARSA released its 2020 Global Fleet & MRO Market Assessment. The report, which was prepared for the association by aviation management consulting firm Oliver Wyman assesses the current state of the global aviation maintenance market and projects continued industry growth through 2030.

The ARSA/OW report is released each March in conjunction with the association’s Legislative Day and used throughout the year to illustrate the industry’s broad economic impact and help leading maintenance companies anticipate future market trends. The 2020 study echoed findings from previous years: The global aviation maintenance industry’s total economic impact will near $100 billion in 2020 and will reach $130 billion by the end of the decade after a period of continued – but slowing – growth. New technologies, airline fleet modernization and the rising global middle class will power aviation business growth, even as they continue to struggle to recruit and retain the technical talent needed to meet expanding demand.

Along with this familiar storyline, including the usual economic uncertainty of long-term forecasts, the Oliver Wyman team chronicled a series of new crises that will challenge growth projections. In addition to the fallout from the United Kingdom’s exit from the European Union – the turmoil leading up to “Brexit” in 2019 gave international regulators time to blunt the worst effects – the new decade has brought new crises in the form of response to a global pandemic (coronavirus) and constraints on new airframes entering the global fleet (resulting from increased 737MAX scrutiny).

“The report shows that interesting times are ahead,” said Brett Levanto, ARSA vice president of operations. “We’re quite used to growth projections by this point, particularly in developing economies, but this year’s come with the recognition that there are a lot of economic moving pieces that could pull [the market] dramatically in one direction or another.”

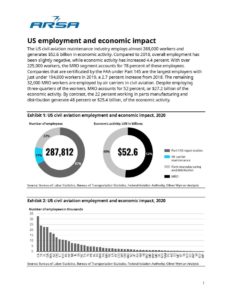

The report’s employment section describes a healthy U.S. market: Almost 288,000 Americans support aviation maintenance and manufacturing, producing more than $52 billion in economic activity each year. FAA-certificated repair stations – the companies forming the core of ARSA’s membership – are the largest employers with just less than 194,000 people at work in their U.S. facilities.

Considering those strong employment numbers and reflecting on the cost to industry posed by its desperate need for more technical workers, Levanto explained that global crises do not change the basic areas in which maintenance providers should focus for growth. “The message [of ARSA’s policy engagement] is consistent: smooth out international regulatory cooperation, stimulate career development and take advantage of the ability of repair stations to specialize by adapting to changing market conditions.”

2020 Global Fleet & MRO MarketAssessment

prepared by Oliver Wyman

|

|

Executive Summary: 2020 Global Fleet & MRO Market Assessment

U.S. state-by-state overview of the 2020 industry employment and economic impact

Oliver Wyman Interactive Forecast Dashboard

The complete report is available only to ARSA members. To request access to it, visit arsa.org/contact.

Having reached the midway point of its 2020 Annual Conference week, ARSA participants return from Legislative Day to two days of regulatory and business content presented through its traditional Annual Repair Symposium. For conference updates throughout the week, visit arsa.org/conference.

Oliver Wyman CAVOK is the transportation industry focused technical consulting and services division within Oliver Wyman, a global leader in management consulting and a wholly owned subsidiary of Marsh & McLennan Companies [NYSE: MMC]. For more information, visit cavok.oliverwyman.com.

3/14/19 - Aviation Maintenance Industry Climbing into Workforce Headwind

March 14, 2019

The aviation industry is poised for another positive year with global spending on maintenance, repair and overhaul services expected to grow by more than $30 billion over the next decade, according to a new report prepared for ARSA by global consulting firm Oliver Wyman.

The new findings were presented by Oliver Wyman’s CAVOK Vice President, Steve Douglas, at a March 13 event on Capitol Hill in conjunction with ARSA’s 2019 Annual Conference.

Rising incomes and consumer spending are pushing passenger air travel to record levels and fueling the largest year-over-year increase of the in-service aircraft fleet since 2008. With 200 million people entering the middle class worldwide, growth in revenue passenger kilometers (RPK) is anticipated to exceed the annual expansion of gross domestic product (GDP) in most economies over the near term, the Oliver Wyman report said.

Cargo volume is also growing, driven primarily by the recent double-digit expansion of e-commerce sales. Air cargo demand as measured by freight tonne kilometers (FTK, which measures metric tonnes of cargo per kilometer) saw an estimated 3.8 percent increase in 2018, while cargo capacity, measured by available FTK, saw an estimated 4.4 percent increase, after a slight contraction in 2017.

The expansion of business in the commercial aviation industry leads to continued growth in the Maintenance Repair and Overhaul (MRO) market. Total global MRO spend is expected to rise to $116 billion by 2029, up from $81.9 billion in 2019. Aside from the growth in the fleet, the increase will be driven by more expensive maintenance visits and technology enhancements.

According to the report, the U.S. civil aviation maintenance industry employs more than 288,000 technicians and generates $50.4 billion in annual economic activity. The top five states for maintenance industry employment are California (33,196), Texas (24,019), Georgia (22,040), Florida (21,614) and Washington (18,518).

Pressure on wages is expected to escalate as the gap grows between the number of pilots and trained aviation maintenance technicians available and the number required for efficient productivity. Labor and fuel are the industry’s two largest operating expenses, representing almost half of total operating costs. According to the analysis, the industry continues to face a looming shortage of technicians – demand for skilled personnel will outstrip supply by more than nine percent in the second half of the next decade if current trends aren’t reversed.

“Long-term trends for fleet growth are strong and with that, future MRO demand is robust. While the competitive dynamics of the MRO industry continue to evolve, there is still a place in the aftermarket for very well positioned, efficient and cost-effective independent MROs.,” Douglas said in his presentation.

An executive summary of the report and state-by-state breakdown of the industry’s economic impact is available at arsa.org/news-media/economic-data. The full report is available only to ARSA members (copies available via ARSA’s secure online portal in the “Tools for ARSA Members” workspace).

2019 Global Fleet & MRO MarketAssessment

by Oliver Wyman CAVOK

|

|

Executive Summary: 2019 Global Fleet & MRO Market Assessment

U.S. state by state overview of the 2019 industry employment and economic impact

Keep up to date on ARSA’s Annual Conference, which runs through March 15, at arsa.org/conference.

3/14/18 - New Aviation Maintenance Industry Report Shows Hopeful Economic Projections, Hard Workforce Truths

March 14, 2018

According a new report, the global aviation maintenance industry will continue to expand its worldwide economic footprint over the next decade. The projections, released on March 14 during an industry event hosted by ARSA, show that expanding global markets and technical enhancements to civil aircraft fleets will drive growth across the maintenance and parts manufacturing sectors.

According a new report, the global aviation maintenance industry will continue to expand its worldwide economic footprint over the next decade. The projections, released on March 14 during an industry event hosted by ARSA, show that expanding global markets and technical enhancements to civil aircraft fleets will drive growth across the maintenance and parts manufacturing sectors.

According to the 2018 Global Fleet & MRO Market Assessment, prepared for ARSA by consulting firm Oliver Wyman, the global air transport maintenance industry employs more than 380,000 people across nearly 5,000 firms that will produce $77.4 billion in market activity in 2018. In the United States, more than 4,000 civil aviation maintenance businesses employ nearly 185,000 people and generate $44 billion in economic activity.

The report was released at a Capitol Hill briefing conducted as a part of ARSA’s annual Legislative Day, an event that has become a highlight of the transportation policy community’s spring calendar. Steve Douglas, former director of the FAA’s aircraft maintenance division and vice president for Oliver Wyman’s CAVOK division, presented this year’s report.

By 2028, the global maintenance market is forecast to surpass $114 billion dollars in annual activity, based on the firm’s projections. As seen in previous reports, maintenance-related revenues are projected to fare well even when a series of alternative scenarios are considered against the baseline forecast. Should air carriers be forced to weather economic turbulence in the next decade, their likely delayed introduction of new aircraft and further dependence on legacy fleets would stabilize spending on maintenance, repair and overhaul services.

However, a looming problem – one that has been recognized by ARSA and the industry for years – is made clear by the report: the desperate need to find and retain a new generation of maintenance technicians. According to Oliver Wyman’s projections, the demand for aircraft mechanics will outstrip the available supply by 2022. By the end of the reports decade-long projection, there will be 10 percent fewer mechanics in the workforce than needed by the industry.

“We can now point to 2022 as the year of reckoning,” said Brett Levanto, ARSA vice president of communications. “Seeing clear analysis showing that a shortfall of aviation maintenance talent in the very near future needs to move us to action now. Many in the industry, including ARSA, have been piecing together a plan for this issue for years. Our first big hurdle was to clearly and directly tell the story, now that we’ve done that it’s time to take action.”

Levanto noted the association’s stepped-up efforts on workforce development issues, which were particularly evident in early March when Sens. Jim Inhofe (R-Okla.), Richard Blumenthal (D-Conn.), Jerry Moran (R-Kansas) and Maria Cantwell (D-Wash.) introduced an ARSA-supported bill to establish a new pilot program to train maintenance professionals, help veterans transition to civilian careers and recruit new technicians. “There are many who have been talking about the [aviation maintenance] workforce crisis for a long time. It’s nice to be part of a group that’s doing something about it – and to have [the Oliver Wyman data] to underscore our urgency,” Levanto said.

The report’s executive summary, as well as a fact sheet illustrating U.S. state-by-state employment figures, is available below. All of ARSA’s available data resources can be found at: arsa.org/news-media/economic-data.

To see everything that happened during ARSA’s Legislative Day, which is a component of the association’s Annual Symposium Week, visit arsa.org/symposium.

2018 Global Fleet & MRO Assessment

by CAVOK, a division of Oliver Wyman

Executive Summary: 2018 Global Fleet & MRO Market Economic Assessment by CAVOK/Oliver Wyman

U.S. state by state overview of the 2018 employment and industry economic impact

3/15/17 - Newest ARSA Report: Positive Trade Balance, Growth Prospects for Global Maintenance

March 15, 2017

Aviation maintenance, an often overlooked but vital segment of the aviation industry, is not only a major employer nationwide making a substantial impact on the U.S. economy; it has achieved a positive balance of trade, a new report finds.

According to the 2017 Global Fleet & MRO Market Assessment, prepared by consulting firm Oliver Wyman for ARSA, the U.S. civil aviation maintenance industry employs more than 277,000 people across the United States and generates $44.1 billion in annual economic activity.

The report found there are more than 3,800 American firms across all 50 states performing maintenance services. Contrary to popular perceptions about the industry, most aviation maintenance work is done “off the aircraft” by highly specialized FAA-certificated facilities working on engines and components. The vast majority of these repair stations, close to 85 percent, are small-to-medium sized businesses employing 50 or fewer people. Overall, thanks to strong performance in component and engine-specific services, the United States enjoys a positive balance of trade for maintenance: American maintenance exports exceed imports by almost $850 million.

The report was released March 15 at a Capitol Hill briefing conducted as a part of ARSA’s annual Legislative Day, an event that has become a highlight of the transportation policy community’s spring calendar. David Marcontell, Oliver Wyman vice president, presented this year’s report.

The total worldwide market for commercial aviation maintenance in 2017 is expected to reach nearly $75.6 billion, Oliver Wyman found. By 2027, global sales will expand to more than $109 billion, based on the firm’s projections. Maintenance providers will see steady demand growth, as fleets expand and new technologies emerge, Marcontell noted during the briefing.

As a further enhancement to this year’s report, the 2017 assessment includes an economic sensitivity analysis that tests the $109 billion projection against four alternative economic scenarios. Ranging from “cloud nine” robust growth to “black swan” disaster, the maintenance market fares relatively well against each variation. In fact, in three of the four situations considered, the market actually outperforms Oliver Wyman’s baseline economic projection. Even when bearish assumptions are made for a “weakened economy,” airline dependence on legacy aircraft would still bolster maintenance, repair and overhaul spend to $111 billion by 2027.

“Basically everything would have to go economically haywire in the global market for maintenance spend to not at least meet projections,” Marcontell said about the analysis. “Even then, the numbers are still in the ballpark of $100 billion in 10 years’ time; in terms of dollars and cents, this is a very durable industry.”

“The most important takeway from this report for members of Congress is that you may not know it, but the aviation maintenance industry plays an important part in your state’s economy,” ARSA Executive Vice President Christian A. Klein said. “So, whether you’re reauthorizing the FAA, refining the tax code, changing trade policy or overhauling the regulatory system, lawmakers need to consider the impact on repair stations and their employees.”

Highlighting the hundreds of thousands of American workers involved in avatiion maintenance, Klein concluded: “We say it a lot, but it bears repeating: We can’t fly without them.”

The report’s executive summary, as well as a fact sheet illustrating U.S. state-by-state employment figures, can be found in ARSA’s economic data center at arsa.org/news-media/economic-data.

For more information – including live updates – on ARSA’s 2017 Legislative Day & Annual Repair Symposium, visit arsa.org/symposium.

3/16/16 - ARSA Releases Annual Economic Report, Highlights Impact of Maintenance

March 16, 2016

With FAA reauthorization bills taking center stage on Capitol Hill, ARSA’s annual economic market assessment once-again highlights the impact of an often unseen part of the aviation industry: maintenance.

The 2016 Global Fleet & MRO Market Assessment prepared by Oliver Wyman was released March 16 at a Capitol Hill briefing. The event, conducted as part of ARSA’s annual Legislative Day, was headlined by House Aviation Subcommittee Member Carlos Curbelo (R-Fla.) and attended by aviation maintenance industry executives and congressional staff.

Steve Douglas, vice president of CAVOK, a division of Oliver Wyman, provided attendees with a maintenance industry overview and the findings of this year’s report. Douglas, a former manager of the FAA’s Aircraft Maintenance Division, noted that the total worldwide market for commercial aviation maintenance is expected to be nearly $68 billion in 2016. The industry, which currently employs 350,000 people worldwide, will approach $100 billion – four percent annual growth – by 2026.

For its part, the U.S. civil aviation maintenance industry employs more than 270,000 people and generates $43.1 billion in economic activity. In total, more than 3,800 American firms scattered through all 50 states perform maintenance, repair and overhaul services. The vast majority of these, close to 90 percent, are small-medium sized businesses employing 50 or fewer people.

“For policymakers the major takeaway from this report is that, although you may not know it, the aviation maintenance industry is part of your state’s economy,” ARSA Executive Vice President Christian A. Klein said. “There are important issues looming in the House and Senate FAA bills that will affect maintenance businesses and their hundreds of thousands of employees nationwide. Each member of Congress needs to pay attention and be mindful of the consequences.”

The report underscores that America is the global leader in this sector but highlights a variety of potential challenges coming over the next decade. Repair stations will have to manage continually increasing cost scrutiny from air carriers and other operators and find ways to leverage new technologies in materials, production, flight data and maintenance techniques.

“With the new generation aircraft coming into the global market over the next 10 years, MROs worldwide will need to adapt to new technology to maintain profitable margins,” Douglas said before the briefing. “Data sharing will become very important with new-generation aircraft and the self-monitoring of systems and components, resulting in gigabytes of data generated on each flight. Properly leveraged, this data is capable of alerting the operators and the MRO of the health of the aircraft systems.”

The report’s executive summary, as well as a fact sheet illustrating U.S. state-by-state employment figures, can be found in ARSA’s economic data center at arsa.org/news-media/economic-data

3/18/15 - ARSA to Congress: You Can’t Fly Without 300,000 American Aviation Workers

March 18, 2015

On Mar. 18, ARSA hosted a dual-premiere event on Capitol Hill to provide both visual and quantitative evidence for the importance of the aviation maintenance industry to American lives and livelihoods.

At a congressional briefing in the Rayburn House Office Building, Rep. Carlos Curbelo (R-Fla.) helped the association unveil You Can’t Fly Without Us – The World of Aviation Maintenance. The seven-minute documentary was developed as part of a series of informational public-television features and is intended to provide a foundational introduction to the work of the men and women who keep the world safely in flight.

The video can be seen on AVMRO.arsa.org, the aviation maintenance industry’s information portal.

After the screening, ARSA released the 2015 Global Fleet and MRO Economic Assessment, prepared by CAVOK, a division of Oliver Wyman. David Marcontell, CAVOK’s vice president, presented an overview of the report’s findings, noting that the total worldwide market for commercial aviation maintenance activity will surpass $100 billion by 2025. On American soil, Marcontell noted that the industry employs nearly 300,000 men and women and generates more than $43 billion in economic activity, while producing more than $5 billion in federal corporate and individual income taxes.

The full report, as well as a fact sheet illustrating U.S. state-by-state employment figures, can be found in ARSA’s economic data center at arsa.org/news-media/economic-data.

“Each year, [the Global Fleet and MRO Economic Assessment] continues to paint a clear picture of a complex, but vibrant industry,” Marcontell said before the event. “People across the world are becoming more connected with each other and demanding even more from the aviation industry to carry them and their products safely and cost-effectively around the globe. As air carriers and other aviation businesses respond to this demand, the already-dynamic aviation maintenance market will march right along in step.”

“The message here is pretty simple,” said Christian A. Klein, ARSA’s executive vice president. “Every single time you land safely, or pick a loved-one up at the airport, or have a package arrive on your doorstep, there’s a maintenance provider somewhere for you to thank. These repair stations, maintenance facilities and component shops – the businesses that ARSA represents every day – are part of a complex global network of services that are vital to our national and global economy. We can tell those stories in many different ways, and this report and our documentary make key points in the overall discussion: You can’t fly without us.”

3/12/14 - New ARSA, TeamSAI Analysis Highlights Industry Economic Impact

March 12, 2014

ALEXANDRIA, VIRGINIA – The Aeronautical Repair Station Association (ARSA) and TeamSAI Consulting (TeamSAI) today released the 2014 Global MRO Market Economic Assessment. The study provides a 10-year forecast of the global air transport maintenance, repair, and overhaul (MRO) market and examines the aviation maintenance industry’s current economic and employment impact.

The report paints a picture of a vibrant $57.7 billion global commercial MRO industry that is expected to grow to $86.8 billion in the next decade. The study also finds that the commercial and business aviation MRO and parts manufacturing/distribution industries combined generate $44.4 billion in economic activity in the United States and employ 244,000 workers across the country. Other issues addressed in the report include the flow of trade between various regions and market conditions in specific maintenance sub-sectors (airframe, engine, component and line maintenance).

“For over 14 years now, TeamSAI has been proud of its role to quantify and clarify for MRO industry leaders the various opportunities and risks facing their businesses. This year is no exception, with significant analysis of repatriation opportunities for many airframe MROs as well as an in-depth analysis of cross-border MRO import/export flows,” said David A. Marcontell, TeamSAI president and COO.

“The report is a valuable new tool,” stated ARSA Executive Vice President Christian Klein. “It will help our members plan for the future, help the public better understand how repair stations fit into the economy, and help policymakers understand the economic implications of laws and regulations that affect repair stations.”

A state-by-state breakdown of the U.S. MRO industry is available here.

###

ARSA is an Alexandria, Virginia-based trade association that represents aviation maintenance and manufacturing companies. Founded in 1984, the association has a distinguished record of advocating for repair stations, providing regulatory compliance assistance to the industry, and representing repair stations on Capitol Hill and in the media. More information is available at www.arsa.org.

TeamSAI, Inc. is a leading aviation services firm known for its innovative yet pragmatic approach to the industry. Services include strategic and tactical consulting services, airline technical support services, and MRO data and benchmarking, specializing in operations and maintenance sectors. With its aviation centered vision of supporting the worldwide community of airline, airports, manufacturers, MROs, VIP completions and corporate/fractional operations, TeamSAI provides unique and customized solutions addressing the most challenging business issues.